Where's HR Tech heading?

This is fine.

Welcome to the 98 newly FullStack HR people who have joined us in the last couple of weeks! If you haven’t subscribed, join 1563 smart, curious folks by subscribing here:

This is a shameless plug for The Talent Company.

(Hint; this is where I work.)

We are hiring!

We work with high-growth companies across Europe, supporting them in all areas of HR. And we are looking for new employees!

Our CEO has written a longer post about us, what makes us stand out from the crowd and why we are not an ordinary HR consulting firm, and most importantly, how to apply.

Holá!

We started our summer vacation last week with a trip to NYC. No kids, just me and my wife. Endless walks and too much food. And no newsletter.

But I'm back this week and have two more weeks before I leave for a good old Swedish vacation, taking four weeks off.

Today it's all about HR Tech and a look into the crystal ball about what might happen in the next 6-18 months. We'll meet back here in late 2023 to see if I was right or not.

Let's get to it.

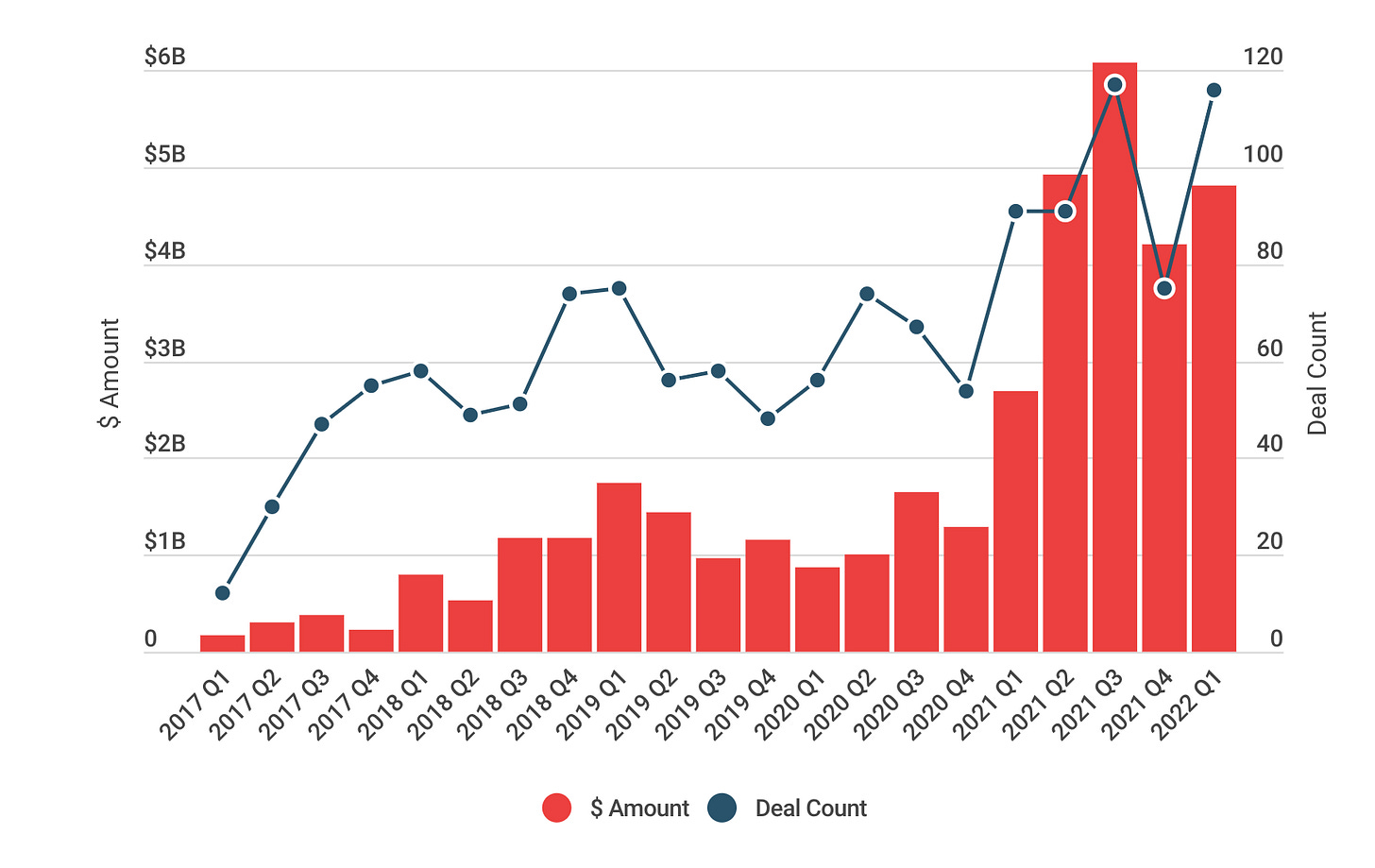

It's no secret that money has been pouring into HR Tech over recent quarters. According to Work Tech, in 2021 we saw a 50% uptick in deals signed for HR Tech compared to 2020, and a whopping 273% increase in allocated capital. Or, to put it even more in perspective, during Q2 in 2021, VCs poured more money into the area than they did during 2020.

Or, for even more historical data - they put more capital into the sector during 2021 than they did the previous four years combined.

There are many different reasons behind the increased share of venture capital in this space. First and foremost, the HR space has been lagging behind, and even though we've seen innovation happen in the area, it's been more incremental shifts rather than giant leaps.

I know this might be a hard truth to take in, but HR Tech has been seen as "unsexy" for quite a long time. But as employees, even before the pandemic, have been demanding more user-friendly ways of navigating the workplace, there's been a surge in great tools to use in the workplace. Long gone are the days when you could host your HR System on a server in your basement, thinking that the employee should be lucky that they could somehow report vacation at all.

During the same period, we've seen the importance of HR rise. It concurs with the rise of the tech sector, which has focused on the employee experience. This, in turn, has led to more efforts around people's practices.

Totally biased here, as always, but now I'm backing up my usually subjective statements with hard cash, e.g., VC dollars.

They (hopefully) see a business case in the companies they choose to invest in, thus meaning that there's a buyer on the other end that also considers the value of buying whatever HR Tech it might be. This means that they acknowledge the importance of HR and thus have great tools. And not only that, over the last year, as VCs invest in HR Tech and know more about the space, they are also keen on making sure the other companies they invest in have sound people practices. An "HR becomes more important"-flywheel.

On top of all this, you have the pandemic with its remote work trends, which has accelerated the need for better tooling, as we talked about last week.

So what?

We've heard the talks of inflation and recession and that it's generally harder to raise capital, should you need any. No one knows what the future might hold, but should we see the downturn in the economy continue, here's what I believe we will see happening in the HR Tech space.

Consolidation

Given how many companies have been started that, in many instances, are trying to solve the same problem, we will most likely see an increase in companies merging together, one way or another. To put it more bluntly, if/when valuations go down, there will be opportunities for the companies with a strong balance sheet to buy other companies. This is both good and bad for us as buyers of HR Tech. It means hopefully better, well-built products as companies join forces. It would be easy to throw in a buzzword as "strong synergy" here, but let's not. On the downside, there's less competition and perhaps less innovation.

Vanishing of Vendors

Most companies aim to change something, big or small and believe that they've found the solution to whatever problem there might be that needs solving. But that's not always the case. And no matter the macroeconomic outlook, companies don't always find market fit. But my sense is that since capital has been relatively easy to get, companies have lived on the hopes of making that big break a bit longer than usual. But if there's no market fit for their products, they will most likely disappear if we enter a bear market.

Opportunities

Let's end on a slightly higher note. Companies with a market fit will likely continue to thrive, but they will be mindful of the times, thus working even closer with us as buyers to ensure they stay relevant. It's a win-win. We get better products, and they get more satisfied customers. And I know some will not do this, but the smaller vendors you work with will undoubtedly be even closer to you.

Now is also the time to look for new vendors. As always, be mindful about who you choose as a vendor. Perhaps ask an extra question about the longevity of their business. Still, as consolidation is happening, as people are working even harder on their market fit and creating more value for us as customers, it is an excellent time to engage with these vendors.

And no, I'm not saying that based on my involvement in evali, AlexisHR, and PayZlip (even if you should check them all out) - but on the back of last week's article, I genuinely believe that we need to do a better job with tooling in general.

And what better time than now to make that investment?